CAPEX Planning Related to Asset Management

Using verified data and condition assessments, we support clients in capital expenditure forecasting and asset replacement planning. Our models help prioritize investments based on asset criticality, performance risk, and remaining useful life, enabling smarter long-term budgeting.

Data-Driven Capital Planning for Tomorrow

Using verified data and condition metrics, we support finance and operations teams in long-term asset planning and budgeting.

- NAsset lifecycle cost models

- NRemaining useful life estimates

- NPrioritized replacement plans

- NFunding allocation recommendations

Plan Today for a Smarter Tomorrow

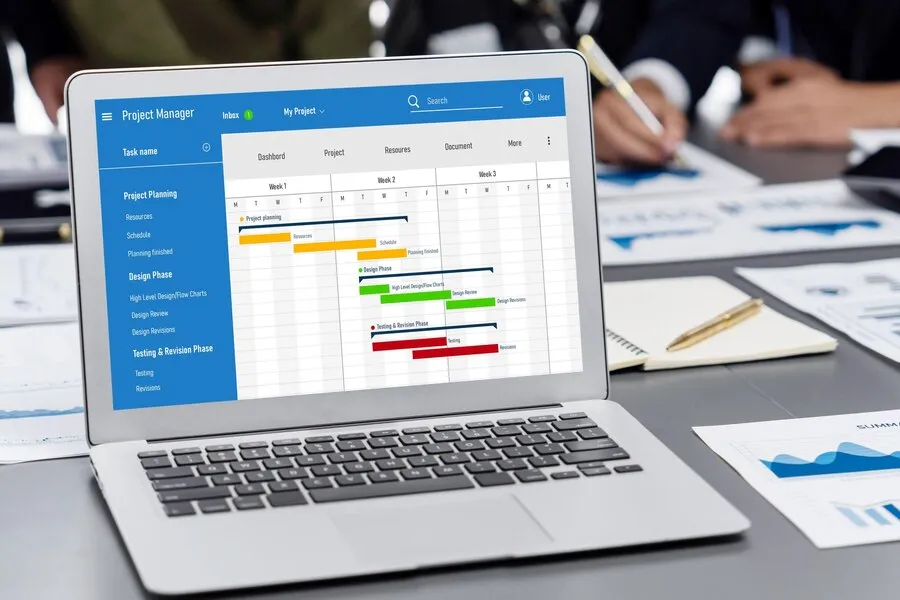

SGE supports finance and operations teams with data-backed capital expenditure (CAPEX) planning using real-world asset data. Our models help organizations forecast asset renewal needs and replacement investments.

- NAsset Criticality Mapping: We identify which assets are critical to operations, safety, or service continuity.

- NUseful Life Estimation: Based on asset condition, age, and manufacturer specifications.

- NReplacement Cost Analysis: CAPEX projections include supply, installation, and commissioning estimates.

- NPrioritization Matrix: CAPEX proposals are ranked by urgency, compliance risk, cost-benefit, and ROI.

- NMulti-Year Planning Reports: Delivered in formats ready for budget submissions and board-level reviews.

This enables strategic allocation of funds, minimizing emergency repairs and optimizing infrastructure investment cycles.

Why CAPEX Planning Matters

Smart capital planning transforms reactive spending into strategic investment. By using actual asset condition and lifecycle data, we help you forecast replacements, reduce emergency spending, and align budgets with operational priorities.

- NDeveloping multi-year asset replacement strategies based on condition, usage, and risk.

- NSubmitting data-backed budgets that are justifiable to executive leadership and finance teams.

- NAvoiding costly surprises by replacing high-risk assets before they fail.

- NMaximizing ROI by prioritizing critical infrastructure investments over non-essential upgrades.

Planned vs Reactive CAPEX – The Financial Impact

Here’s how structured CAPEX planning compares to a reactive approach:

Planned CAPEX

Asset Replacement Timing

Based on condition and life cycle analysis

Cost Efficiency

Controlled, budgeted spending

Decision-Making

Data-driven, long-term focused

Budget Alignment

Aligned with annual or multi-year plans

Impact on Operations

Minimal disruption, scheduled downtime

Audit Readiness

Fully documented with justifications

Reactive CAPEX

Asset Replacement Timing

After breakdown or failure

Cost Efficiency

Emergency premiums and downtime costs

Decision-Making

Rushed, based on urgency

Budget Alignment

Unplanned expenditures and overruns

Impact on Operations

High risk of service interruptions

Audit Readiness

Often lacks traceability or forecasting

The Result

Better financial control, fewer operational surprises, and asset investments that support long-term growth and reliability.